The U.S. solar industry continues to evolve, and the latest insights from the SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report for Q2 2023 shed light on key trends and developments in the sector. Released on September 7, 2023, this quarterly report provides valuable information about the state of the U.S. solar market. In this article, we’ll explore the key figures and findings from the report, offering a comprehensive overview of the current state of the U.S. solar industry.

Key Figures

1. Installation Growth and Market Share

In Q2 2023, the U.S. solar market installed an impressive 5.6 gigawatts-direct current (GWdc) of solar capacity. This marks a substantial 20% increase compared to Q2 2022. Despite this robust growth, there was an 8% decrease in installations compared to the preceding quarter, Q1 2023. However, it’s important to note that the first half of 2023 saw nearly 12 GWdc of solar capacity installed, suggesting a positive trend for year-over-year growth, a reversal from the contraction experienced in 2022.

Solar energy’s contribution to the national grid is noteworthy, with solar accounting for a substantial 45% of all new electricity-generating capacity added in the first half of 2023. This highlights the increasing role of solar energy in meeting the country’s power needs.

2. Segment-Specific Insights

Residential Segment: The residential solar segment demonstrated resilience, rebounding from a slight dip in the previous quarter. Q2 2023 set a quarterly record with 1.8 GWdc of residential solar installations. This growth was particularly notable in California, where installations surged ahead of the mid-April transition from net metering to net billing. Experts anticipate this installation surge to continue into the third quarter before potentially tapering off in the fourth quarter.

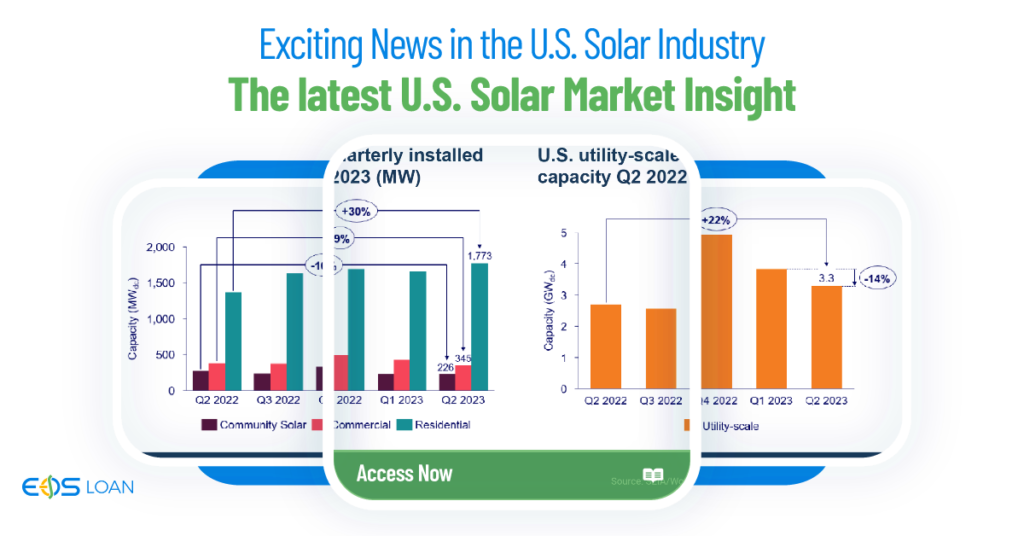

Commercial Segment: The commercial solar segment installed 345 MWdc, representing a 9% decrease compared to Q2 2022 and a 20% decrease compared to the previous quarter, Q1 2023. Despite the decrease in capacity, there was a 7% increase in the total number of projects installed, indicating relative stability in the segment.

Community Segment: The community solar segment installed 226 MWdc, which was 16% less than in Q2 2022 and remained flat compared to the preceding quarter. While there is considerable momentum in community solar development, installation volumes have stagnated in several states due to challenges related to interconnection, market penetration, and siting and permitting.

Utility-Scale Segment: The utility-scale solar segment installed 3.3 GWdc in Q2 2023, representing a substantial 22% growth compared to Q2 2022. However, this figure marked a 14% decline from the previous quarter, Q1 2023. Despite this quarterly decline, the second-quarter capacity build continued the momentum from the 66% year-over-year growth seen in Q1 2023. This indicates progress in overcoming supply chain challenges, albeit with ongoing difficulties in equipment logistics.

Policy Impact: The Inflation Reduction Act (IRA)

Since the passage of the Inflation Reduction Act (IRA) a year ago, module manufacturers have announced plans for numerous capacity additions. If all these plans materialize, the U.S. (including Puerto Rico) will experience a significant increase in total module manufacturing capacity, growing from 10.6 GW to 108.5 GW by 2026. The IRA has instilled optimism in the solar industry, and it is expected to drive continued growth.

Growth Outlook

After experiencing a 13% market contraction in 2022, Wood Mackenzie anticipates the U.S. solar industry to grow by an impressive 52% in 2023, with nearly 32 GWdc of capacity expected to be installed. A record 20 GWdc is projected to be installed during the second half of the year, surpassing all annual totals prior to 2021. Over the next five years, annual growth in the solar industry is expected to average 15%, reflecting the long-term policy certainty provided by the IRA.

Conclusion

The SEIA/Wood Mackenzie Q2 2023 report offers a comprehensive snapshot of the U.S. solar industry’s current status and future prospects. Despite challenges such as supply chain constraints, the industry continues to demonstrate resilience and growth. Solar energy’s increasing contribution to the national grid, policy support through the IRA, and a positive outlook for the coming years indicate that the U.S. solar industry is poised for sustained expansion.

As the industry navigates supply chain dynamics and policy intricacies, stakeholders are adapting to meet the growing demand for solar energy. With innovation and investment, the U.S. solar sector remains a vital player in the country’s transition to cleaner and more sustainable energy sources.

For further insights and detailed market segment outlooks, the full SEIA/Wood Mackenzie Q2 2023 report is recommended reading for anyone interested in the future of solar energy in the United States.